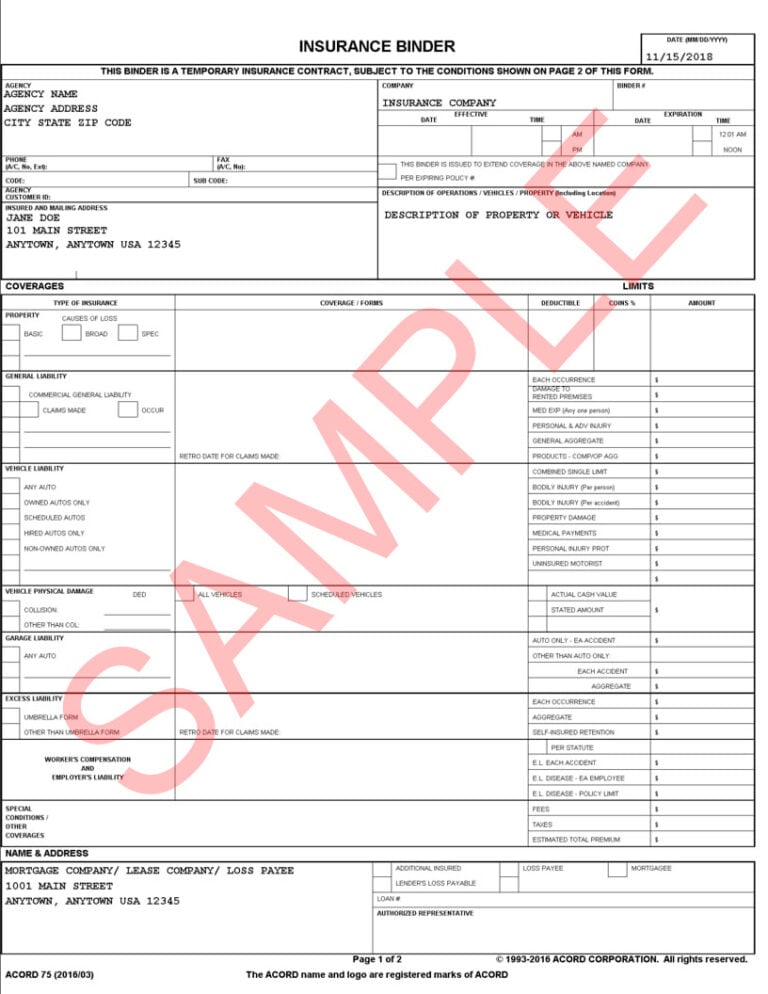

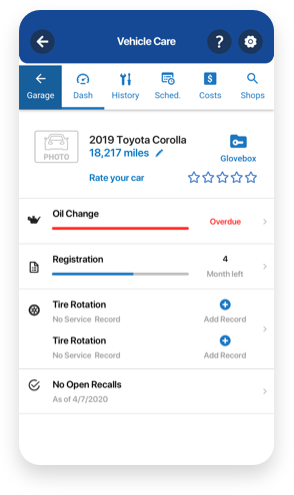

An insurance binder allows you to have proof of insurance and make claims in the meantime if you need to. Sometimes issuing a new policy can take days or even over a week, leaving you uncovered. Case Studies: Illustrating the Practical Use of Insurance BindersĪn insurance binder is a temporary insurance policy document that gives you coverage while your policy is being issued.When should you get an insurance binder?.To begin your journey of getting good car insurance and put your knowledge of insurance binders to use, enter your ZIP code into our free tool to compare insurance quotes today. Luckily, that’s where insurance binders come in.īut what’s an insurance binder? How do I get an insurance binder? What does it do for me? When do I even need one? These are all important questions that can be answered in detail in this article. This can cause issues when you’re trying to drive a new car off the lot or trying to get a car loan from a bank. When getting car insurance, there can sometimes be difficulties in getting your policy information right away. An insurance binder is needed when waiting for a full policy to be established and can be requested from the insurance company as needed.Insurance binders have all the coverage of normal insurance but only last a short time of 30 to 60 days, or until the full policy is available.

Insurance binders are temporary insurance policy documents that are issued while a full policy is being underwritten.

0 kommentar(er)

0 kommentar(er)